This can be a free service which searches a database of greater than 200,000 workplace and private pension schemes to attempt to find the contact details you want.

pensions meaning in urdu

Recommendation and steerage about pensions including info on the latest pension updates (together with the 2019 wage band contribution modifications), pensions recommendation and key paperwork. From 1 April 2019 the contribution bands for employee pension contributions to the Lecturers’ Pension Scheme are rising by 2.4 per cent. The FSCS security does apply for those who lose money because of the pension or funding firm going bust. It’s only a pot of cash that you just, and your employer, will pay into – and which you get tax relief on – as a manner of saving up to your retirement.

Recommendation and steerage about pensions including info on the latest pension updates (together with the 2019 wage band contribution modifications), pensions recommendation and key paperwork. From 1 April 2019 the contribution bands for employee pension contributions to the Lecturers’ Pension Scheme are rising by 2.4 per cent. The FSCS security does apply for those who lose money because of the pension or funding firm going bust. It’s only a pot of cash that you just, and your employer, will pay into – and which you get tax relief on – as a manner of saving up to your retirement.

This £eighty five,000 restrict has been prolonged to pensions and investments from 1 April 2019. These statements embody an estimate of the retirement income that the pension pot might generate once you reach retirement. These scams are so damaging the federal government banned cold calling about pensions in January 2019.

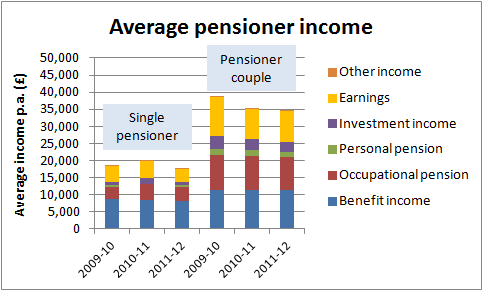

It will also provide help to understand how any future Nationwide Insurance contributions would possibly improve the quantities shown. When you have a defined benefit pension scheme, you will obtain a specified level of revenue that is labored out based on components such as your closing pensionable wage and years of pensionable service.

From 6 April 2019, the minimum employer contribution degree elevated to three%. Under auto enrolment, whole contributions have to be a minimum of 8%, so if the employer only places in three%, the employee has to contribute 5%. See Martin’s you’re likely about to get a pay rise, however it could price you weblog.

Then at retirement, you may draw money out of your pension pot in various ways or use the cash to buy something referred to as an annuity, which pay an everyday income until demise. If you happen to’re employed (aged 22-plus and incomes at the least £10,000 a 12 months), you may be auto-enrolled right into a pension to which your employer must contribute at least three% of your salary (inside certain limits).

pension fund canada

You will want 35 qualifying years to get the complete new State Pension if you don’t have a National Insurance document earlier than 6 April 2016. You don’t have to stop working while you reach State Pension age, but you’ll no longer must pay National Insurance coverage. UNISON works to defend good pension schemes and improve and promote inexpensive, respectable pensions for all our members, wherever you work.

conclusion

In case you have a defined contribution scheme, it’s best to examine whether or not there are any penalties for retiring late. Each qualifying yr in your National Insurance record from 5 April 2016 will add about £four.70 a week to your new State Pension.