This is a free service which searches a database of more than 200,000 workplace and private pension schemes to attempt to discover the contact particulars you need.

pensions regulator auto enrolment

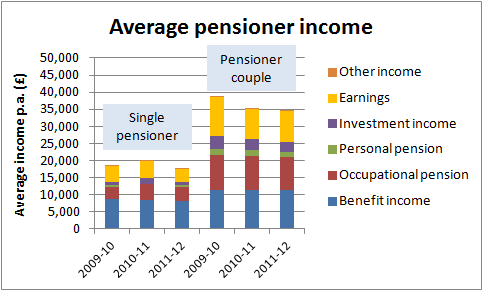

You pay into your pension every month. As a member of the nursing workforce, you can save to your retirement through a pension scheme. It is a free service which searches a database of greater than 200,000 workplace and personal pension schemes to try to discover the contact details you want. With money purchase pensions, also called defined contribution schemes, the money you put into your pension plan is invested and what you’ve at retirement is determined by how these investments have carried out.

You pay into your pension every month. As a member of the nursing workforce, you can save to your retirement through a pension scheme. It is a free service which searches a database of greater than 200,000 workplace and personal pension schemes to try to discover the contact details you want. With money purchase pensions, also called defined contribution schemes, the money you put into your pension plan is invested and what you’ve at retirement is determined by how these investments have carried out.

In case you are working within the impartial sector you might have the choice to pay into a pension scheme organized by your employer that each you and your employer make a contribution into. You need to get your first payment inside 5 weeks of reaching State Pension age.

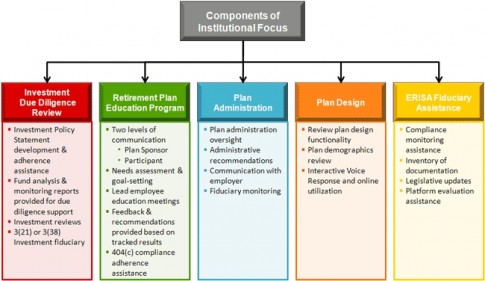

Once more, it is best to check together with your scheme’s administrator or pension provider to seek out out what dying advantages could also be payable to them. Employer pension contributions are set to rise from 16.four per cent to 23.6 per cent in September 2019. In case you’re in a defined contribution scheme, it could be potential that a lump sum might be paid to your dependants.

UNISON works to defend good pension schemes and enhance and promote inexpensive, respectable pensions for all our members, wherever you work. Some pension savers being paid a regular earnings from their retirement funds could be heading for catastrophe. This protection’s offered by the UK’s Financial Services Compensation Scheme (FSCS, see the Savings Safety information).

From 1 April 2019 the contribution bands for employee pension contributions to the Teachers’ Pension Scheme are rising by 2.four per cent. The FSCS safety does apply for those who lose cash because of the pension or investment agency going bust. It’s just a pot of money that you simply, and your employer, can pay into – and which you get tax aid on – as a approach of saving up on your retirement.

what is a pension annuity uk

You get the tax back you’ve paid on all contributions, when you’re beneath 75, subject to an annual allowance. From 6 April 2016, you could possibly get more State Pension by including qualifying years to your Nationwide Insurance coverage file. If you’re working within the independent sector you will have the option to pay into a pension scheme organized by your employer that each you and your employer make a contribution into.

conclusion

Nonetheless, not all employers have supplied pensions. A pension is essentially a pot where you, and your employer (if it’s a company pension), will pay into – and which you get tax relief on – as a approach of saving up on your retirement.