This £85,000 limit has been prolonged to pensions and investments from 1 April 2019. The Pension Safety Fund offers with defined-benefit schemes when an employer goes bust.

pension definition plan

Most individuals contribute to their pensions yearly. Usually, your pension scheme will provide benefits in your death. It’s easier to breach your annual pension contributions allowance than you may think. A pension is essentially a pot the place you, and your employer (if it is a company pension), can pay into – and which you get tax reduction on – as a means of saving up in your retirement.

Most individuals contribute to their pensions yearly. Usually, your pension scheme will provide benefits in your death. It’s easier to breach your annual pension contributions allowance than you may think. A pension is essentially a pot the place you, and your employer (if it is a company pension), can pay into – and which you get tax reduction on – as a means of saving up in your retirement.

Aegon is without doubt one of the world’s main suppliers of life insurance coverage, pensions and asset management. If you have an outlined benefit scheme, you may need your employer’s or the trustees’ permission to retire late. In April 2016 to March 2018, almost half (forty eight%) of all private pension wealth was held in pensions in payment, 37% in active pensions and 15% in preserved pensions; these proportions have been stable over time.

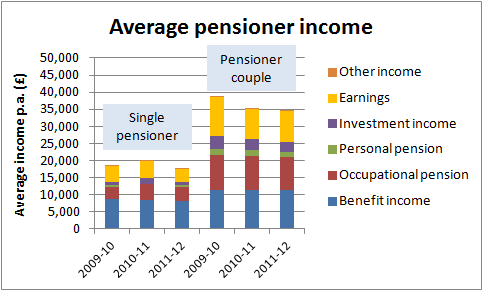

So as to plan for your retirement, it’s essential to determine how much earnings you will get from all of your pensions, together with workplace or private plans, in addition to the State Pension. If you happen to’re a member of a office pension scheme, you typically require the consent of the employer or ex-employer to take advantages early.

You get some tax again on the money you set into a pension, whereas features from the investments you make with that cash are largely tax-free. National Insurance coverage contributions or credit in your Nationwide Insurance report before 6 April 2016 may even rely in the direction of your new State Pension.

The NHS Pension Scheme is the occupational pension scheme for workers working for the NHS or for an organisation offering NHS companies. The federal government have addressed this many occasions, with costs to the taxpayer being the primary purpose given. Members with deferred pensions may have their career common pension rights elevated by 2.4 per cent in April 2019.

what is a pension plans

Regardless of how old you might be, there’s all the time a price in saving into a pension scheme, notably if your employer is also prepared to contribute. Handle the running costs associated with providing a office pension scheme. Employer pension contributions are set to rise from 16.4 per cent to 23.6 per cent in September 2019. A key plus of a pension plan is the tax relief, which comes in two kinds relying on whether or not you’re a basic-fee or larger-rate taxpayer.

conclusion

This paper addresses one of many fundamentals of actuarial practice: assessing the solvency of a defined benefit pension scheme. This protection’s supplied by the UK’s Financial Companies Compensation Scheme (FSCS, see the Savings Security information).