Your Retirement Planner will help you’re taking control of your financial savings, set your retirement targets and perceive what choices you’ve gotten in your cash.

account officer pension artinya

A terrific good thing about pension schemes is you can often begin taking money from them from the age of 55. This is effectively earlier than you’ll be able to receive your State Pension. If you wish to trace a workplace pension – a scheme run by an employer – then your first level of contact should be the employer. You must verify along with your scheme’s administrator to check what death advantages may be payable. In case you are a member of the scheme in Northern Ireland, see the HSC Pension Service website for extra data.

A terrific good thing about pension schemes is you can often begin taking money from them from the age of 55. This is effectively earlier than you’ll be able to receive your State Pension. If you wish to trace a workplace pension – a scheme run by an employer – then your first level of contact should be the employer. You must verify along with your scheme’s administrator to check what death advantages may be payable. In case you are a member of the scheme in Northern Ireland, see the HSC Pension Service website for extra data.

With auto-enrolment , your employer must contribute in direction of your pension, plus you get tax relief of at the least 20% (tax relief signifies that for each £4 you place into your pension, you get tax aid of £1 – the identical increase as with the Lifetime ISA).

Auto enrolment now requires employers to offer staff a pension, to mechanically enrol you within the scheme and, crucially, to contribute in your behalf. With these, you get a percentage of your final pre-retirement salary, or when leaving that agency, as an annual revenue.

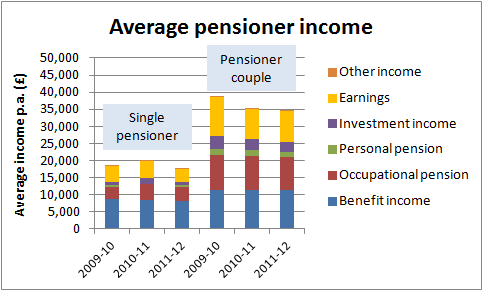

When you have a defined contribution pension scheme, you build up your individual pot of cash. You will not get the Additional State Pension in the event you reached State Pension age on or after 6 April 2016. Most workplace pensions and all personal pensions are cash purchase. If you’re in a defined profit pension scheme, there may be an income payable to your dependant.

Plus, a pension’s just one type of retirement planning. Because it comes out of your PRE-TAX salary and straight into your pension, you pay less national insurance (NI). When you only have closing salary service after that date, or have any profession common service, you may not obtain an automated lump sum while you take your benefits.

pension fund definition economics

Members with deferred pensions will have their career average pension rights elevated by 2.four per cent in April 2019. Go to for more info on office and private pensions For extra data in your specific occupational pension, speak to your employer’s payroll or human assets department. In case you are working within the impartial sector you will have the option to pay right into a pension scheme arranged by your employer that each you and your employer make a contribution into.

conclusion

TPT’s DB Full answer, for Outlined Profit pension schemes, provides administration, trusteeship, actuarial, legal, investment providers, scheme accounting, covenant evaluation and member communications all underneath one roof.