When you’ve got a personal pension, you do not want the consent of an employer or the pension supplier to take advantages early, if the terms and situations of your contract assist you to do that.

pension fund denmark

You pay into your pension every month. As life expectancy will increase and pension arrangements and values change, it’s extra important than ever to be sure to plan for your retirement. Should you’ve acquired a defined profit (ultimate wage) pension, there’s a threat of your employer going bust, leaving you with no pension revenue.

You pay into your pension every month. As life expectancy will increase and pension arrangements and values change, it’s extra important than ever to be sure to plan for your retirement. Should you’ve acquired a defined profit (ultimate wage) pension, there’s a threat of your employer going bust, leaving you with no pension revenue.

Your Retirement Planner can help you are taking control of your savings, set your retirement targets and understand what choices you may have for your money. So when a fundamental 20% charge taxpayer invests £80 of their take-dwelling pay in a pension, they’d have actually earned £a hundred before tax.

In most cases, your pension scheme will present advantages on your demise. It’s simpler to breach your annual pension contributions allowance than you might suppose. A pension is actually a pot the place you, and your employer (if it’s an organization pension), can pay into – and which you get tax reduction on – as a method of saving up on your retirement.

AÂ pension calculated by multiplying your service by your common wage after which dividing by 60. TPT’s DB Full solution, for Outlined Benefit pension schemes, gives administration, trusteeship, actuarial, authorized, funding companies, scheme accounting, covenant evaluation and member communications all beneath one roof.

This is successfully a pay rise, so beware of giving it up, plus there isn’t any tax to pay on pension contributions (topic to annual allowances, above). If your pension just isn’t going to be not less than equal to your expected GMP when it becomes payable, early retirement might not be potential.

what is a pension scheme trustee

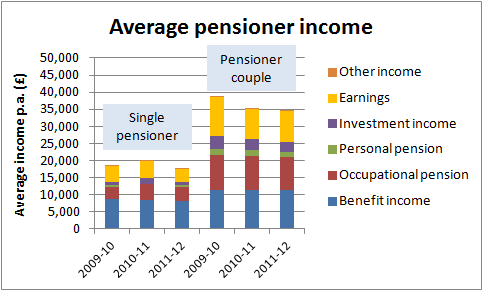

For those who’re nonetheless an lively member of that scheme, then there will in all probability also be a lump sum cost made to your dependants which is commonly a a number of of your pensionable wage. In April 2016 to March 2018, almost half (48%) of all personal pension wealth was held in pensions in payment, 37% in active pensions and 15% in preserved pensions; these proportions have been stable over time.

conclusion

In case you have an outlined contribution pension scheme, you construct up your own pot of cash. When you’ve obtained a defined profit (final wage) pension, there’s a threat of your employer going bust, leaving you with no pension income.