Should you’re nonetheless an energetic member of that scheme, then there will probably even be a lump sum cost made to your dependants which is usually a a number of of your pensionable salary.

pensive itu artinya

In simple terms, a pension scheme is just a sort of savings plan that will help you save money for later life. If you have a non-public pension, you don’t want the consent of an employer or the pension supplier to take benefits early, if the phrases and conditions of your contract help you do that. For each £2 over £a hundred and fifty,000, the allowance tapers down by £1, that means anyone incomes a complete revenue of £210,000 or more will only get £10,000 tax reduction yearly.

In simple terms, a pension scheme is just a sort of savings plan that will help you save money for later life. If you have a non-public pension, you don’t want the consent of an employer or the pension supplier to take benefits early, if the phrases and conditions of your contract help you do that. For each £2 over £a hundred and fifty,000, the allowance tapers down by £1, that means anyone incomes a complete revenue of £210,000 or more will only get £10,000 tax reduction yearly.

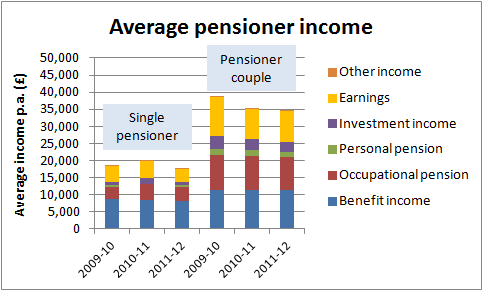

Manage the running costs related to providing a office pension scheme. Should you’re approaching retirement, suppose twice before exercising your right to take 25% of your pension fund financial savings as a tax-free money lump sum. Effectively you are giving up disposable income now in trade for a future pay rise (within the type of pension income).

The Pension Safety Fund offers with outlined-profit schemes when an employer goes bust. The compensation payable to some members of the Teachers’ Pension Scheme may be less than the authorized fees being quoted, and some members may very well have gained from the adjustments during which case no compensation can be payable.

Whether or not you’ve gotten a defined profit or outlined contribution pension scheme, you’ll be able to often start taking cash from the age of fifty five. You can use this to assist high up your wage in case you are nonetheless working, to enable you to work fewer hours or to retire early.

There are additionally some circumstances whenever you could possibly take cash out of your pension even earlier than fifty five, corresponding to should you’re in poor health or in a career the place your regular retirement age is earlier than normal, for example if you’re an expert athlete.

pension definition francais

Go to for more information on office and personal pensions For extra data on your specific occupational pension, converse to your employer’s payroll or human sources division. You want the name of an employer or a pension supplier to make use of the service. For those who’re approaching retirement, assume twice earlier than exercising your proper to take 25% of your pension fund savings as a tax-free cash lump sum.

conclusion

It’s best to examine with your scheme’s administrator to check what dying advantages could also be payable. Should you’re approaching retirement, think twice earlier than exercising your right to take 25% of your pension fund savings as a tax-free money lump sum.