As a whole, craft brewers have also capitalized on an excise tax break included in President Trump’s 2017 tax cuts, reducing what they pay the government for every barrel produced.

turbo taxi parts three colts lane

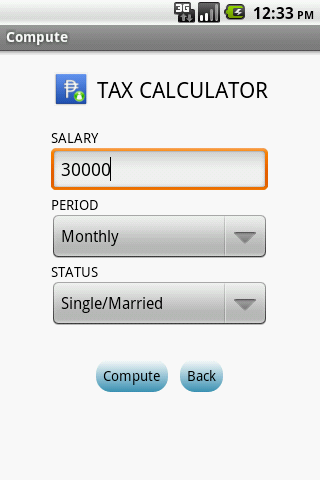

Shortly calculate how much tax you should pay in your income. Instead of increasing customer charges, the company plans to apply federal tax reform financial savings toward those storm prices. Quicken import not accessible for TurboTax Enterprise. The corporate has given all of its U.S. employees either a $1 an hour pay increase or a one-time bonus of $1,000.

Shortly calculate how much tax you should pay in your income. Instead of increasing customer charges, the company plans to apply federal tax reform financial savings toward those storm prices. Quicken import not accessible for TurboTax Enterprise. The corporate has given all of its U.S. employees either a $1 an hour pay increase or a one-time bonus of $1,000.

In economics, taxes fall on whomever pays the burden of the tax, whether or not that is the entity being taxed, similar to a business, or the end shoppers of the enterprise’s items. This plan, which President Trump endorsed in his State of the Union address , permits American households to take a $5,000 advance on their Little one Tax Credit score.

Pay for TurboTax out of your federal refund: A $40 Refund Processing Service payment applies to this fee technique. Covers 1099-MISC within Schedule C. Feature presently out there for new TurboTax filers with 1099-MISC income. Tax methods differ extensively amongst nations, and it is important for people and companies to fastidiously research a new locale’s tax legal guidelines earlier than incomes income or doing enterprise there.

The extension of the FET rates will liberate $20,000, which can permit us to purchase the manufacturing equipment crucial to satisfy our projections and achieve our objectives.â€Â – Dec. Every earnings group in every Nevada congressional district received a tax lower Nationwide, a typical family of 4 acquired a $2,000 annual tax minimize and a single parent with one little one received a $1,300 annual tax lower.

We’ll transfer your info robotically from your federal tax return to your state return, so you do not have to. TaxSlayer makes it easy to prepare and e-file your state taxes. The bonuses, totaling about $23 million, stem from an enormous tax benefit that Ryder will receive because of adjustments within the recently passed Tax Cuts and Jobs Act, which reduces federal company tax charges to 21 % from 35 percent.

tax evasion contoh

They all would elevate revenue taxes on high earners, elevate taxes on capital earnings just like the sale of stocks and bonds and raise the corporate revenue tax fee. The Democrat plan, the Household and Medical Insurance Depart (FAMILY) Act, launched by Senator Kirsten Gillibrand (D-NY) and Congressman Rosa L. DeLauro (D-CT), would improve payroll taxes to create an Workplace of Paid Family and Medical Go away inside the Social Safety Administration.

conclusion

The Democratic candidates have put ahead their plans to spend trillions of dollars on new social programs at a time when the federal budget deficit is anticipated to exceed $1 trillion this year — having risen sharply underneath Mr. Trump, largely because of his tax cuts.